Understanding Our Privacy Policy Structure in South Africa

Our privacy policy forms the backbone of data protection across HFM’s services within South Africa. It ensures full adherence to local laws and transparency in how we manage your information. The policy details how personal data is gathered, processed, stored, and your rights as a trader in South Africa. We collect data only as needed for account operations, transaction handling, and lawful obligations. Updates to this policy are communicated promptly to maintain trust and compliance.

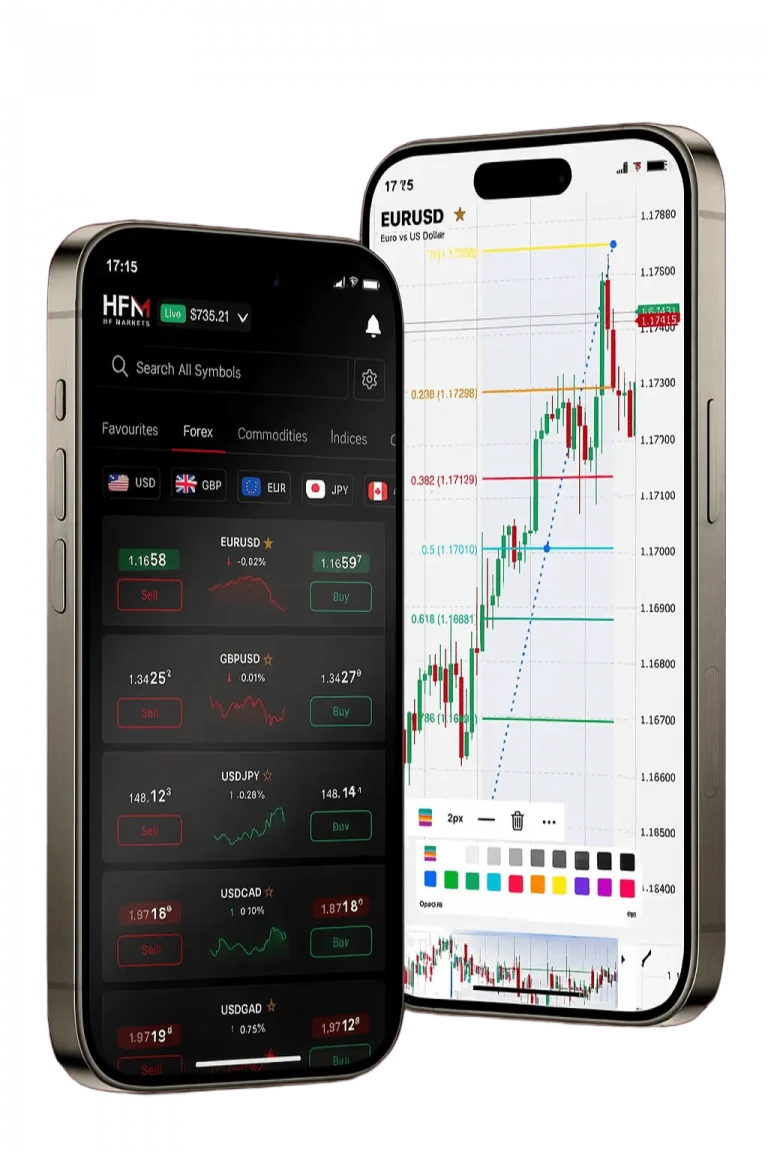

The framework incorporates specific standards for financial service providers operating in South Africa. It applies to all interactions on our trading platforms, websites, mobile apps, and customer support channels. We use advanced encryption and secure storage to safeguard your data.

- Methods of personal data collection

- Data processing protocols

- Retention schedules

- Information sharing restrictions

- User rights and control options

- Security measures and encryption standards

- Compliance with South African regulations

Clients are informed of policy changes via email and platform alerts. Legal reviews ensure all updates comply with South Africa’s data protection laws.

| Data Category | Collection Method | Retention Period | Security Level |

|---|---|---|---|

| Personal Information | Registration Form | 7 Years | AES-256 Encryption |

| Trading Data | Platform Activity | 5 Years | Multi-layer Protection |

| Financial Records | Transaction Processing | 7 Years | Bank-grade Security |

| Communication Logs | Support Interactions | 3 Years | Secure Storage |

Personal Information Collection Procedures

Registration Data Requirements

When opening an account with us, clients must provide personal details such as full name, birthdate, address, contact information, and identification documents. This allows us to authenticate your identity and comply with South African financial regulations. We require proof of address documents that are recent (within three months) and valid government-issued IDs.

The registration process involves multiple verification steps to prevent fraud and identity theft. Additional documents may be requested for specific account types or enhanced due diligence. Data collected is limited strictly to what is necessary for account management and legal compliance.

Trading Activity Monitoring

We continuously monitor trading actions to uphold platform security and adhere to anti-money laundering laws. This includes tracking transaction histories, trading patterns, deposits, withdrawals, and platform usage. Security systems analyse login locations, devices used, and timestamps to detect suspicious behaviour.

All monitored data is confidential and solely used for compliance and risk management. This ensures the trading environment remains secure for all South African users.

Data Processing and Usage Policies

We process your data strictly for legitimate purposes including account management, trade execution, customer service, and regulatory requirements. Our systems ensure data accuracy and relevance, meeting South African data protection standards. All processing activities are documented for audit and compliance purposes.

Automated systems monitor transactions for fraud detection, while complex cases undergo manual review. We also process data to personalise your trading experience and communicate updates, subject to your consent where required.

- Identity verification and account maintenance

- Transaction execution and settlement

- Risk and fraud management

- Customer support communications

- Regulatory reporting obligations

- Service improvement initiatives

- Marketing communications with explicit consent

Aggregated data patterns are analysed to improve platform features without compromising personal privacy. Privacy impact assessments are conducted prior to implementing new analytical tools.

Information Sharing and Third-Party Disclosure

Regulatory Reporting Requirements

HFM complies with South African law by sharing relevant data with authorities such as the Financial Sector Conduct Authority (FSCA). This covers suspicious transaction reporting, large cash transaction declarations, and compliance monitoring. All information shared is limited to what regulations mandate.

We maintain detailed audit trails for all regulatory disclosures and protect the confidentiality of shared data. This ensures transparent and secure cooperation with regulatory bodies.

Service Provider Partnerships

We collaborate with third-party providers for payment processing, cloud storage, and customer support. Each partner undergoes rigorous due diligence and must comply with strict data protection agreements. These agreements mandate secure handling and restrict data usage to agreed purposes only.

Our partners include payment gateways, cloud infrastructure providers, and identity verification services. Regular audits verify ongoing compliance with South African and international privacy standards.

| Partner Type | Data Shared | Purpose | Protection Level |

|---|---|---|---|

| Payment Processors | Transaction Details | Payment Processing | PCI DSS Compliant |

| Cloud Providers | Encrypted Data | Secure Storage | ISO 27001 Certified |

| Verification Services | Identity Documents | KYC Compliance | GDPR Compliant |

| Support Partners | Communication Logs | Customer Service | Confidentiality Agreements |

Data Security and Protection Measures

At HFM, we implement multiple security layers to safeguard your personal and trading data. Our systems use AES-256 encryption for stored data and TLS 1.3 protocols for data in transit. These technologies ensure confidentiality and integrity of your information.

Access to sensitive data is controlled by role-based permissions, requiring multi-factor authentication for all employees. Regular password updates and detailed access logging further enhance security.

- Encryption using AES-256 and TLS 1.3

- Intrusion detection and firewall systems

- Regular vulnerability assessments

- Incident response and threat management

- Business continuity and disaster recovery plans

Physical security at our data centres includes biometric access controls, 24/7 surveillance, and environmental monitoring. Redundant infrastructure guarantees continuous service availability even during emergencies.

Incident Response Procedures

Our incident response team swiftly addresses data breaches or security incidents. The team includes IT specialists, legal advisors, and compliance officers. Regular drills ensure preparedness for rapid threat containment, impact evaluation, and client notification.

We maintain transparent communication with affected parties and regulators, documenting all incidents to prevent recurrence. This approach aligns with South African and international data protection laws.

User Rights and Data Control Options

Clients in South Africa have rights under our privacy policy and local legislation, including access, correction, deletion, and restriction of their personal data. We offer clear procedures to exercise these rights via our dedicated customer support channels.

Requests are typically processed within 30 days, with extended timeframes communicated when necessary. Verification steps prevent unauthorised access or data manipulation.

- Access to personal data and portability

- Correction and update of inaccurate information

- Restriction of processing activities

- Deletion of data where applicable

- Opt-out of marketing communications

- Withdrawal of consent at any time

- Submission of privacy complaints

Our client portal supports self-service for updating contact details, managing communication preferences, and viewing transaction history. More complex requests can be submitted through our data protection contact points.

Communication Preferences Management

Clients can adjust communication settings for marketing emails, platform notifications, and service messages via their account. Opt-out requests are honoured immediately except for essential communications such as security alerts and regulatory updates.

We maintain separate categories for marketing and essential communications to ensure compliance with South African privacy requirements.

| Communication Type | Opt-out Available | Legal Basis | Frequency |

|---|---|---|---|

| Marketing Emails | Yes | Consent | Weekly |

| Security Alerts | No | Legitimate Interest | As Required |

| Transaction Notices | No | Contract Performance | Per Transaction |

| Regulatory Updates | No | Legal Obligation | As Required |

Data Retention and Deletion Policies

We retain personal data based on South African legal requirements, business needs, and regulatory mandates. Financial records are kept for seven years, while communication logs remain for three years. Expired data is securely deleted unless legal holds apply.

Trading data is accessible during active accounts and retained for five years after closure. Verification documents also remain for seven years to comply with anti-money laundering laws.

Regular data purging ensures obsolete data is removed securely, with destruction certificates maintained for audits.

Account Closure Procedures

Upon account closure, required data is retained as per regulatory timelines, and unnecessary information is deleted. Clients receive confirmation regarding data removal and can request copies of retained data during retention periods.

We finalise outstanding transactions and balances before closure to ensure compliance and data integrity.

Compliance and Regulatory Framework

HFM’s privacy policy complies with South African data protection laws, including POPIA, and financial services regulations. We regularly monitor compliance and update policies to reflect legal or regulatory changes. Our legal team reviews all updates to maintain adherence to South African requirements.

We engage in industry initiatives promoting best practices and monitor international standards affecting cross-border data transfers. External audits verify our compliance and data security measures.

| Compliance Area | Scope | Frequency |

|---|---|---|

| POPIA | Data Protection and Privacy | Continuous |

| FSCA Regulations | Financial Sector Conduct | Ongoing |

| AML Regulations | Anti-Money Laundering | Ongoing |

| International Data Transfers | Cross-border Data | As Required |

| Cybersecurity | Data Security Measures | Regular Audits |

Annual privacy impact assessments identify risks and inform policy improvements. Clients are notified about significant privacy policy changes via email and platform notices. Our Data Protection Officer manages all privacy inquiries and ensures regulatory compliance.

We welcome client feedback to enhance our privacy practices continuously.

❓ FAQ

How does HFM protect my personal data in South Africa?

HFM uses advanced encryption (AES-256, TLS 1.3), role-based access controls, and continuous monitoring to secure your data. Physical data centre security and strict partner agreements further protect information.

What rights do South African traders have regarding their data?

Clients can access, correct, delete, or restrict processing of their personal data. They can also manage communication preferences and withdraw consent as per South African privacy laws.

How long does HFM retain my trading and financial data?

Financial records are kept for seven years, trading data for five years after account closure, and communication logs for three years, complying with South African regulations.

Can I opt out of marketing communications?

Yes, marketing emails can be opted out via your account settings or customer support. Essential service communications cannot be opted out due to legal and security requirements.